In Oregon, a vehicle is declared a total loss when the repair costs reach 75% or more of its actual cash value (ACV). This is known as the Oregon total loss threshold, and it guides insurance companies in deciding whether to repair a damaged car or deem it a total loss. Understanding this threshold can help car owners navigate insurance claims and set realistic expectations.

Key Takeaways

- A vehicle in Oregon is declared a total loss when repair costs exceed 75% of its Actual Cash Value (ACV), combined with salvage value.

- The ACV is determined by several factors, including vehicle condition, mileage, make, model, age, and location, which significantly affect total loss settlements.

- Car owners should be proactive in understanding their rights, filing claims, and disputing valuations to ensure fair compensation during the total loss claims process.

What Constitutes a Total Loss in Oregon?

In Oregon, a vehicle is declared a total loss when the cost to repair it exceeds its market value and salvage value combined. If the combined repair costs and salvage value exceed the car’s pre-accident worth, the vehicle is classified as a total loss. This often happens when the repair costs are impractical relative to the car’s value. Insurance companies use these criteria to determine if the vehicle can be repaired.

Certain circumstances make a car more likely to be deemed a total loss, such as:

- Severe damage in an accident

- Severe damage from a flood

- The cars are unsafe to drive even after repairs, which may not be covered. Understanding these criteria prepares you for such situations.

Oregon’s Total Loss Threshold Explained

The total loss threshold in Oregon is set at 75% of the vehicle’s actual cash value (ACV). This means:

- If the cost to repair your car is 75% or more of its ACV, the insurance company will likely declare it a total loss.

- Insurance companies have the flexibility to use a lower percentage.

- However, they cannot go below the state-mandated 75% threshold.

Car owners should be aware of this threshold. If repair costs are near this percentage, consider the possibility of the vehicle being declared a total loss. Typically, being aware of the threshold aids in navigating total loss claims and setting realistic expectations.

Calculating Actual Cash Value (ACV)

The Actual Cash Value (ACV) of your vehicle is a critical figure in the total loss determination process. ACV represents the market value of your car before it was damaged. Insurance companies consider several factors when calculating ACV, including:

- The vehicle’s condition

- Mileage

- Make

- Model

- Age

- Location

This comprehensive assessment ensures that the ACV reflects the car’s true worth at the time of the accident.

To verify the ACV of your car, you can use online resources like Kelley Blue Book or consult with a dealership for an estimate. This step is crucial, as an accurate ACV can significantly impact your total loss settlement. If you decide to keep the totaled vehicle, the insurance payout will be the difference between the car’s pre-loss value and its salvage value.

Having a clear understanding of your car’s ACV empowers you during settlement negotiations. This ensures fair compensation and aids in making informed decisions during the claims process.

Let's Settle For More... Get Your FREE Case Review Today.

Let's Settle For More... Get Your FREE Case Review Today.

Salvage Value Considerations

Several factors influence the salvage value, including:

- The vehicles make

- Model

- Year

- Current condition

The salvage value can significantly affect the settlement amount offered by insurance companies in the retail market, as it is reflected in the potential resale value of the totaled vehicle and the money involved to sell it.

Knowing how salvage value is determined helps in navigating the total loss claims process and securing a fair settlement.

Steps to Take When Your Car Is Declared a Total Loss

Once your car is declared a total loss, there are several important steps to take. First and foremost, communicate promptly with your lender if you have an outstanding balance on the vehicle. This step ensures that any excess amount from the insurance payout reaches you.

Next, you need to file an insurance claim, assess the damage report, and understand your settlement offer. These actions are critical to ensuring you receive fair compensation and can make informed decisions about your totaled vehicle.

File an Insurance Claim

After your car is declared a total loss, follow these steps:

- Contact your insurance company and file a total loss claim.

- Filing a claim promptly initiates the process and ensures timely handling of your case.

- The insurance company will provide a written explanation outlining how the vehicle’s value was assessed and why it was declared a total loss.

This written notice provides transparency and clarifies the basis for the insurance company’s decision regarding the business. It also serves as a reference point should you need to dispute the valuation or seek further clarification.

Assess the Damage Report

Reviewing the damage report and the appraisal report is essential in the total loss claims process. If you disagree with the insurer’s evaluation of damages, consider the following steps:

- Seek a second assessment.

- Engage a third-party expert to provide a more accurate appraisal.

- Use the expert’s appraisal to support your discussions with the insurer.

Thoroughly reviewing the damage report and obtaining a second opinion, if needed, can significantly impact your inspection settlement outcome. Promptly addressing discrepancies ensures an accurate assessment of your vehicle’s condition and helps secure a fair settlement without any fault.

Understand Your Settlement Offer

Comprehending your settlement offer is vital in the total loss claims process. In Oregon, insurance companies must provide written notifications detailing the total loss determination process and the vehicle valuation method used. Researching your car’s actual cash value using tools like Kelley Blue Book empowers you during settlement negotiations.

If you negotiate, the insurer must pay the undisputed amount while the claim is still in dispute. Being aware of how your vehicle’s loan status affects the total loss settlement is also crucial, as insurers pay only the car’s market value, not the owed amount. The payment must reflect the car’s value.

Oregon regulations permit an appraisal process where:

- Both the insured and the insurer can obtain valuations in case of a dispute.

- An umpire may be appointed to resolve any disagreement on the vehicle’s value.

- If the appraised value is higher than the company’s offer, insurance companies must cover reasonable appraisal costs.

Retaining a Totaled Vehicle

Choosing to retain your totaled vehicle will result in a reduced insurance payout by the car’s salvage value. The ‘owner-retainer option’ allows you to keep the car, receiving reimbursement minus its salvage value. However, retaining a totaled vehicle may result in receiving less cash and potentially higher insurance costs.

There are several options for a totaled vehicle, including selling it for parts or repairing it for driving conditions. Review Oregon’s DMV laws about titling a totaled vehicle if you decide to keep it.

Legal Requirements and Regulations

When a vehicle is declared a total loss, insurers must notify the DMV. Insurance providers must disclose the appraisal or valuation reports used to assess your vehicle’s worth. Your insurance policy may include an appraisal provision, where each party covers their appraiser’s cost, and the company refunds reasonable appraisal expenses if the outcome favors you.

Additionally, a lienholder may prevent an owner from keeping a totaled vehicle if there is an outstanding loan. Knowing these legal requirements ensures compliance with all regulations and helps you navigate the total loss claims process smoothly, including understanding ownership issues.

Practical Tips for Handling a Total Loss

Handling a total loss situation can be overwhelming, but practical tips can make the process more manageable. When starting your claim, documents related to the accident and vehicle condition are essential. Organizing all necessary documentation, such as the vehicle’s title and any police reports, is crucial for effective communication with insurers.

Regular communication with your insurance adjuster can help keep your claim status updated and potentially expedite the process. Note that storage fees can become your responsibility if you do not promptly accept the insurance company’s guaranteed offer.

Frequently Asked Questions

What is the total loss threshold in Oregon?

In Oregon, the total loss threshold is 75% of the vehicle’s actual cash value (ACV). This means if the repair costs exceed this percentage, the vehicle is considered a total loss.

How is the actual cash value (ACV) of a vehicle calculated?

The actual cash value (ACV) of a vehicle is determined by evaluating its condition, mileage, make, model, age, and location. This comprehensive assessment helps ensure an accurate representation of the vehicle’s worth.

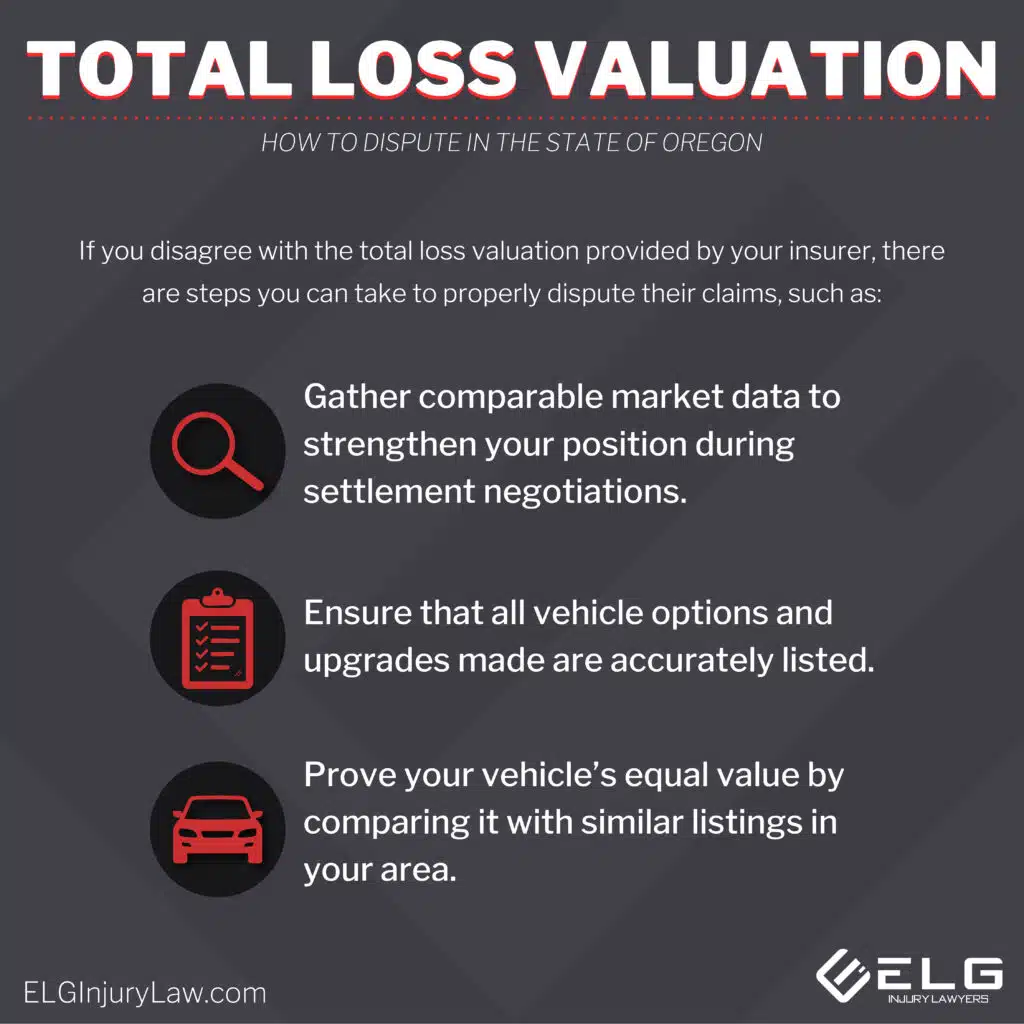

What should I do if I disagree with the insurance company's valuation of my totaled vehicle?

If you disagree with the insurance company’s valuation of your totaled vehicle, gather comparable market data and ensure all options are accurately listed. Then, request an independent appraisal to support your claim. Taking these steps will strengthen your position and may lead to a more favorable outcome.

Can I keep my totaled vehicle?

Yes, you can keep your totaled vehicle, but be aware that your insurance payout will be reduced by its salvage value.

What legal requirements must be met when a vehicle is declared a total loss in Oregon?

When a vehicle is declared a total loss in Oregon, insurers are required to notify the DMV, provide appraisal reports, and a lienholder may prevent the owner from retaining the vehicle if a loan is outstanding. It’s crucial to ensure compliance with these regulations for proper handling of a total loss situation.

Related Articles

Navigating ORS Hit and Run Laws in Oregon

How Much Does It Cost to Hire a Car Appraiser?

Last updated Thursday, September 4th, 2025